By MAJID KHAN Msc Finance

Let’s break down the difference between Profit Maximization and Wealth Maximization in simple terms, then explain why Wealth Maximization is more important.

Table of Contents

hide

🧮 1. What is Profit Maximization?

Goal: Earn the highest possible profit in the short term.

🔹 Characteristics:

- Focuses only on short-term earnings

- Ignores risk and timing of returns

- Doesn’t consider long-term sustainability

✅ Example:

A company cuts costs by using low-quality materials. Profit increases this year, but customers stop buying later.

💰 2. What is Wealth Maximization?

Goal: Increase the overall value of the business (shareholders’ wealth) over the long term.

🔹 Characteristics:

- Focuses on long-term growth

- Accounts for risk and time value of money

- Increases firm value or share price

✅ Example:

A company invests in R&D to make better products. It may earn less now, but increases company value over time.

⚖️ Key Differences Summary

| Feature | Profit Maximization | Wealth Maximization |

|---|---|---|

| Time Focus | Short-term | Long-term |

| Risk Consideration | Ignored | Included |

| Future Cash Flows | Ignored | Considered |

| Time Value of Money | Ignored | Considered |

| Goal | Maximize profits | Maximize shareholder wealth |

| Sustainability | Often low | High |

🌟 Why is Wealth Maximization So Important?

1. Long-Term Value Creation

- Builds a strong, sustainable company

- Attracts investors and keeps them happy

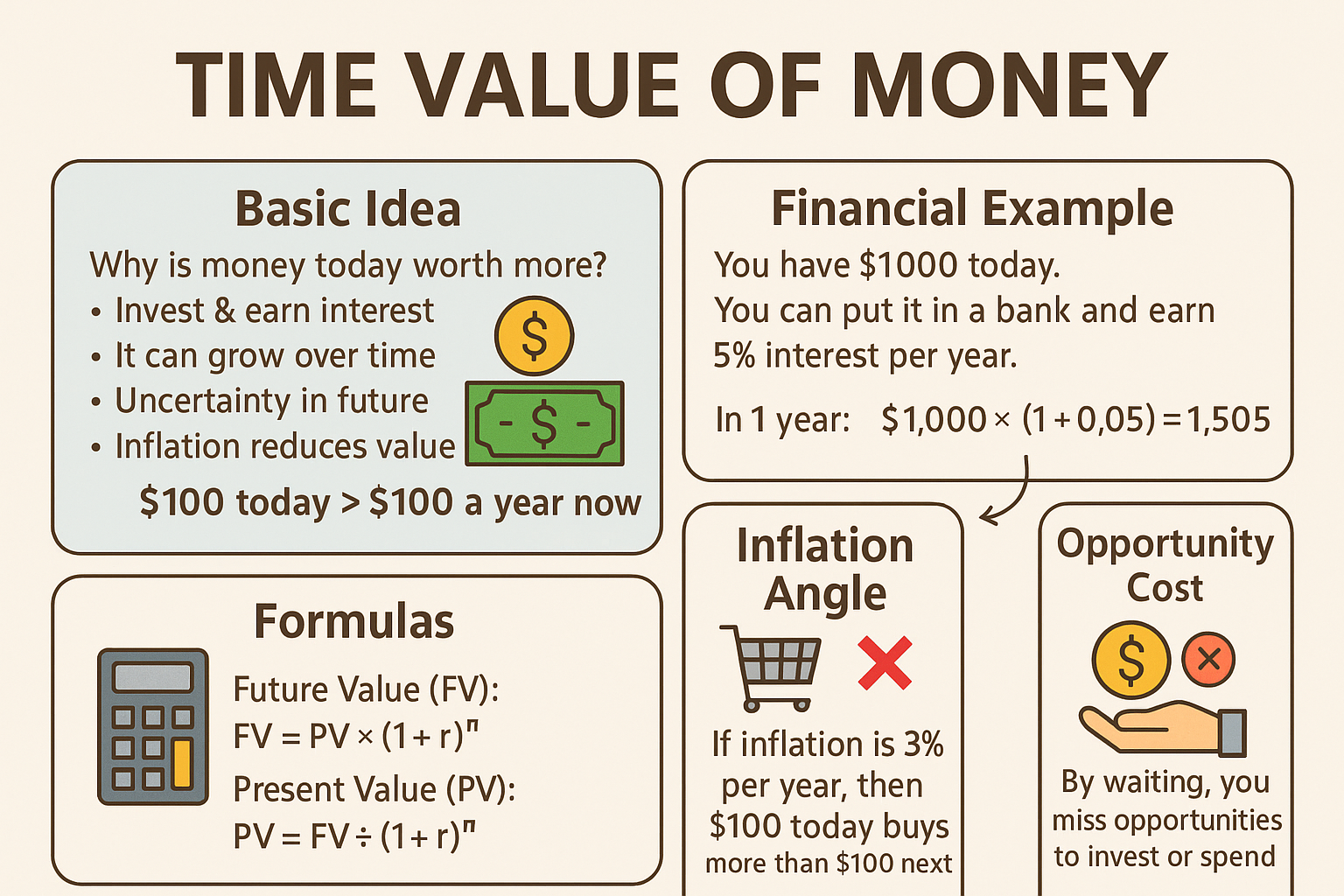

2. Accounts for Risk and Timing

- Future money is worth less (TVM)

- Riskier returns are discounted

3. Reflects True Success

- A company may have high profits now but still lose value (e.g., if customers or assets decline)

4. Guides Better Decisions

- Encourages smart investments, innovation, and ethical practices

📚 In Simple Words:

Profit Maximization asks: “How much money can I make right now?”

Wealth Maximization asks: “How can I build something valuable and lasting?”