By MAJID KHAN Msc Finance

Pakistan’s economy is a developing mixed economy, with agriculture, industry, and services all playing significant roles. However, it faces numerous structural challenges that hinder sustainable growth. Here’s a detailed overview of the economy of Pakistan and the key challenges it faces:

1. Overview of Pakistan’s Economy

GDP and Economic Structure

- GDP (2024 estimate): ~$350 billion (nominal)

- GDP per capita: ~$1,500 (one of the lowest in South Asia)

- Growth rate: Historically volatile, around 2-3% in recent years due to political instability, inflation, and fiscal constraints.

Sectoral Composition:

- Agriculture (22-24%):

- Employs ~38% of the labor force.

- Major products: wheat, rice, cotton, sugarcane, and livestock.

- Vulnerable to water shortages and climate change.

- Industry (19-21%):

- Textiles dominate exports (over 50%).

- Other sectors: cement, steel, food processing, pharmaceuticals.

- Services (55-60%):

- Includes banking, retail, real estate, transport, and communications.

Key Exports:

- Textiles and garments

- Rice

- Leather goods

- Sports goods

- Surgical instruments

Key Imports:

- Petroleum products

- Machinery

- Food items

- Chemicals

- Electronics

2. Key Challenges Facing Pakistan’s Economy

A. Fiscal and Debt Issues

- High fiscal deficits (often 6-8% of GDP).

- Rising public debt: Over 70% of GDP.

- Heavy reliance on external financing from the IMF, World Bank, and friendly countries (e.g., China, Saudi Arabia).

- Limited tax base: Tax-to-GDP ratio below 10%, among the lowest globally.

- Widespread tax evasion and a large informal economy.

B. Balance of Payments and Foreign Exchange Crisis

- Chronic current account deficits.

- Low foreign exchange reserves (often under 2 months of import cover).

- Frequent currency depreciation due to balance of payments pressures.

- Heavy import reliance (especially energy), combined with low export diversification.

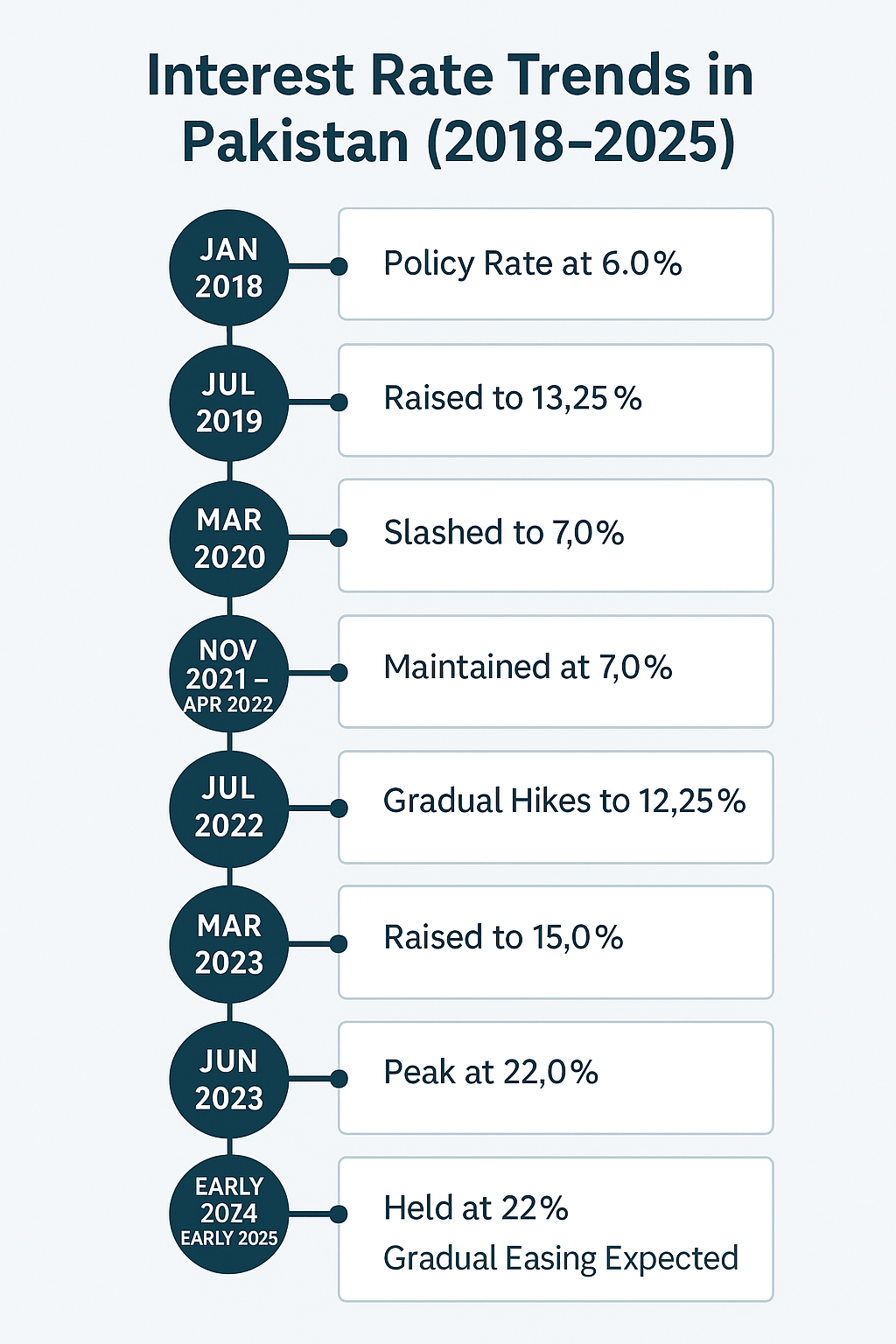

C. Inflation and Cost of Living

- High inflation: Often in double digits (15–30% in recent years).

- Causes include food and fuel prices, currency depreciation, and fiscal mismanagement.

- Reduced purchasing power, especially for the poor and middle class.

D. Energy Crisis

- Power shortages and load-shedding.

- Circular debt in the energy sector (over PKR 2.5 trillion).

- Dependence on imported fuels increases vulnerability to global price shocks.

- Delays in transitioning to renewable energy.

E. Political Instability

- Frequent changes in government and weak governance.

- Military influence in policymaking.

- Poor implementation of economic reforms.

- Corruption and lack of accountability.

F. Climate Change and Environmental Stress

- Pakistan is one of the most climate-vulnerable countries.

- Major floods (e.g., 2022 disaster) caused billions in damage.

- Water scarcity, desertification, and glacial melt pose long-term risks to agriculture and urban settlements.

G. Structural Issues in Agriculture and Industry

- Low productivity in agriculture.

- Fragmented landholdings and outdated farming techniques.

- Lack of value addition and technology in industry.

- Poor integration into global supply chains.

H. Education, Health, and Human Capital

- Low public spending on education (~2% of GDP) and health (~1%).

- Low literacy and skill levels.

- Gender disparity in labor force participation.

- Brain drain: skilled workers often migrate for better opportunities.

I. External Dependence

- Repeated IMF programs (over 20 times since 1958).

- Heavy reliance on remittances from overseas Pakistanis (over $30 billion annually).

- Strategic dependence on countries like China (e.g., CPEC), the US, and Gulf states.

3. Opportunities and Potential

Despite the challenges, Pakistan has significant potential if structural reforms are enacted:

- Demographic advantage: Young population (over 60% under 30).

- Strategic location: Connectivity between South Asia, Central Asia, and the Middle East.

- CPEC (China-Pakistan Economic Corridor): Investment in infrastructure and energy, though debt sustainability is a concern.

- IT and freelancing: Growing digital services sector; potential to earn foreign exchange.

- Agricultural reforms and water management could improve food security and exports.

- Tourism: Rich in cultural and natural heritage, if security and infrastructure improve.

4. Recent Developments (as of 2024-2025)

- IMF Stand-by Agreement (2023): Prevented immediate default, but reforms are lagging.

- Privatization plans for loss-making state enterprises (e.g., PIA, steel mills).

- Currency devaluation and import restrictions to stabilize reserves.

- Efforts to digitalize taxation and expand the tax net.

- Mounting political tensions affecting investor confidence.

Conclusion

Pakistan’s economy is at a critical crossroads. With its young population, strategic location, and natural resources, it holds promise. But without consistent reforms in fiscal policy, governance, energy, education, and trade, the country will continue facing boom-bust cycles, poverty, and instability.