The boom-and-bust cycle—also known as the economic cycle or business cycle—is a natural part of any economy. It represents the repeating pattern of economic growth and decline. Understanding this cycle is essential for investors, policymakers, and anyone interested in how economies rise and fall.

📈 What Is the Boom-and-Bust Cycle?

The boom-and-bust cycle refers to the alternating phases of economic expansion and contraction over time. These cycles can affect everything from jobs and wages to inflation, interest rates, and investment opportunities.

🔑 Keywords:

- Boom and bust cycle

- Economic cycle

- Business cycle

- Recession and recovery

- Economic expansion and contraction

🔄 4 Key Phases of the Boom-and-Bust Cycle

1. Boom (Expansion Phase)

During the boom phase:

- GDP grows steadily

- Unemployment is low

- Consumer confidence is high

- Businesses invest and expand

- Wages and demand rise

👉 However, too much growth can lead to inflation and overheating of the economy.

2. Peak

At the peak:

- The economy hits its maximum output

- Resources are fully used

- Prices and wages may rise unsustainably

- Central banks may raise interest rates to cool inflation

The peak is usually a turning point before the downturn begins.

3. Bust (Recession or Contraction Phase)

In this phase:

- Economic growth slows down or becomes negative

- Unemployment rises

- Consumer spending drops

- Corporate profits fall

- Business investment declines

If severe, this phase becomes a recession, marked by two consecutive quarters of negative GDP growth.

4. Trough (Bottoming Out)

The trough is the lowest point in the cycle:

- Unemployment is high

- Consumer and business confidence are low

- Governments and central banks often respond with stimulus spending and interest rate cuts

From here, the economy begins to recover and starts the cycle again.

💡 Why the Boom-and-Bust Cycle Happens

The cycle is driven by a mix of economic, psychological, and policy-related factors:

- Consumer and investor confidence

- Access to credit and loans

- Government spending and monetary policy

- Global events like pandemics or geopolitical conflicts

📉 Real-World Example of a Boom and Bust

2008 Financial Crisis:

- Boom: Easy credit and a housing bubble

- Bust: Mortgage defaults, banking collapse, and global recession

- Trough: Massive government bailouts and stimulus packages

- Recovery: Gradual return to growth over the next decade

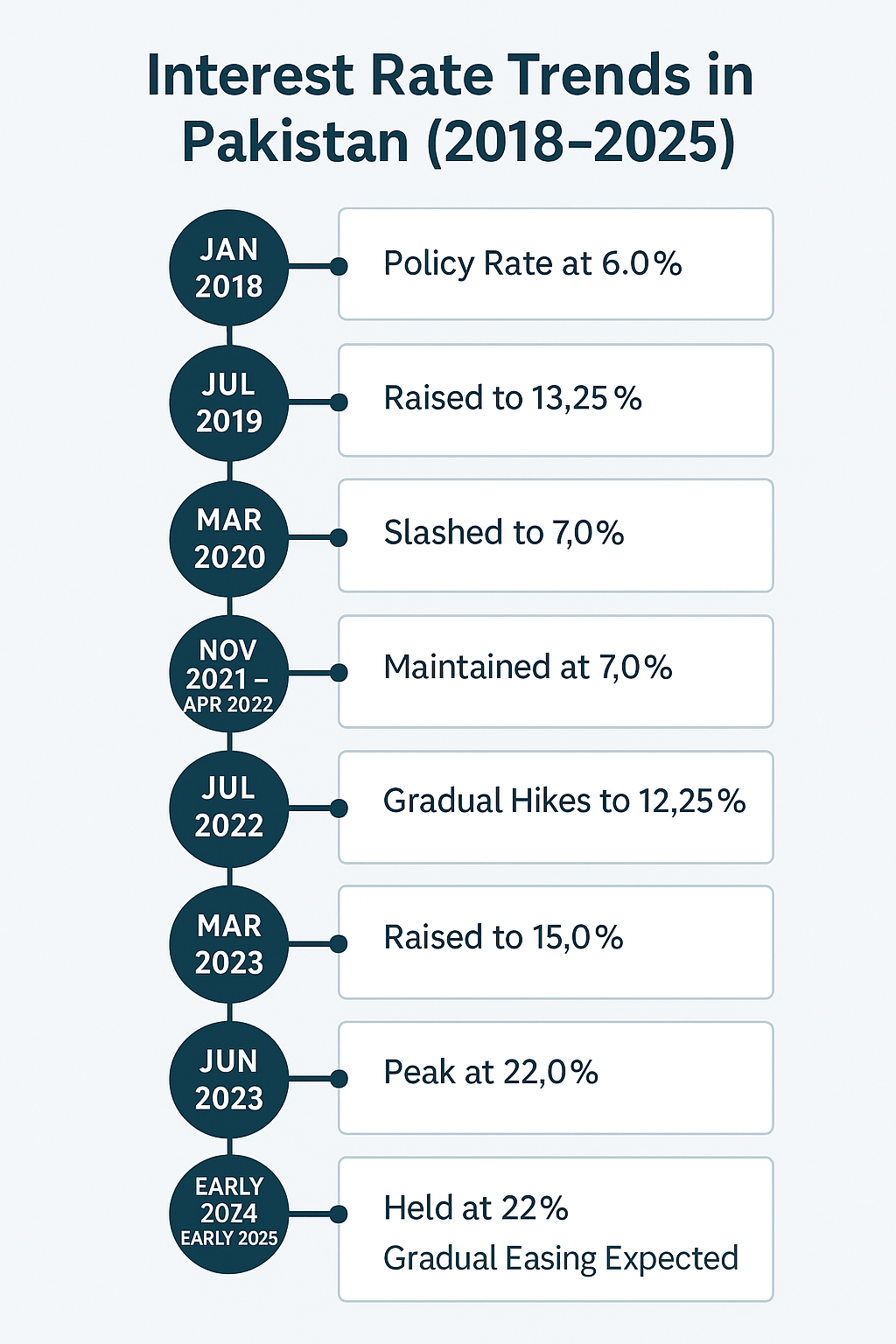

📊 Visual: The Economic Cycle (Chart Below)

Scroll down to see a chart illustrating each phase of the boom-and-bust cycle clearly.

📚 Final Thoughts: Why It Matters

Understanding the boom-and-bust cycle helps:

- Make better investment and career decisions

- Understand government policies

- Prepare for economic downturns

📌 Whether you’re a student, investor, or entrepreneur, knowing how the economic cycle works can help you navigate uncertainty with greater confidence.